AceleraDev Data Science Project - Recommender System to Generate Leads based on Clients’ Portfolio

Table of Contents

- Introduction

1.1 Objective

1.2 Technical Requirements

1.3 Defining the Process

1.4 The Dataset

1.5 Packages Imports - Exploratory Data Analysis

2.1 Load Market Data

2.2 Describing Market Database

2.3 Defining Missing Values Threshold

2.4 Identifying ID and Constant Features

2.5 Verifying Features’ Types

2.5.1 Float Features

2.5.2 Integer Features

2.5.3 Categorical Features

2.6 Imputing Missing Values

2.6.1 Missing Values of Numeric Features

2.6.2 Missing Values of Categorical Features

2.7 Feature Selection - Algorithm Evaluation and Overview of Steps to be Taken

3.1 Types of Recommender Systems

3.2 Selected Approach and Steps - Model Training

4.1 Load Portfolio Data

4.2 “Companies Profile” Table / Principal Components DataFrame

4.3 Clustering Companies with MiniBatchKMeans

4.4 Functions to Create Rating table and to Train Logistic Regression by Cluster

4.5 Logistic Regression Training - Model Performance

5.1 Logistic Regression Metrics

5.2 Functions to Make Recommendations

5.3 Evaluating Recommendations

5.3.1 Notes on Results - Visualizing Results

6.1 Making New Recommendations for Portfolio 2

6.2 Visualizing Clients / New Leads for Portfolio 2 - Conclusion and Next Steps

- References

1.0 Introduction

1.1 Objective

This project’s objective is to provide an automated service that recommends new business leads to a user given his current clients portfolio. Check out the deployed WebApp Leads Finder and a high level video explanation of the analysis in portuguese is available on youtube, link in the image.

1.2 Technical Requirements

- Use data science and machine learning techniques to develop the project;

- Present the development and outputs in a Jupyter Notebook or another similar technology;

- The analysis must consider the steps:

- exploratory data analysis;

- data cleaning;

- algorithm assessment/selection;

- model training;

- model performance assessment;

- results visualization.

- The time taken to train and give outputs must be less than 20 minutes.

1.3 Defining the Process

- Business problem: Which companies from the populace have the highest probability of becoming new clients given the current client portfolio. The solution must be applicable/useful to any user with a client portfolio.

- Analytical problem: For this project, a Content Based Filtering Recommender System based in Logistic Regression predicted probabilities is going to be used. I call it recommender system in a generalist manner, you’ll see it’s not quite like the examples of recommender systems around (and I don’t mean more complex or smart or even good), but it does recommend leads!

- Technological architecture: It’ll be required:

- A streamlit dashboard in which the user can insert his client portfolio. The dashboard can be deployed in heroku or utilized via a local server;

- The portfolio needs to have the clients IDs;

- The dashboard will return the leads with highest predicted probabilites of being clients, based on logistic regression done in smaller clusters, since the dataset has around 460E3 companies;

- The solution will not conisder the addition of new companies to the database.

1.4 The Dataset

estaticos_market.csv: .csv file, it’s compressed file (.zip format) is available at the project’s github repo. contains IDs for 462298 companies. Contains 181 features, including id. Eventualy refered as complete/whole dataset or market database.estaticos_portfolio1.csv: .csv file, contains clients’ ids for the owner of portfolio 1. Contains IDs for 555 client companies. It also has 181 features, including ids, which are the same as in the complete dataset.estaticos_portfolio2.csv: .csv file, contains clients’ ids for the owner of portfolio 2. Contains IDs for 566 client companies.estaticos_portfolio3.csv: .csv file, contains clients’ ids for the owner of portfolio 3. Contains IDs for 265 client companies.

1.5 Packages Imports

from zipfile import ZipFile

import pandas as pd

import numpy as np

import seaborn as sns

import matplotlib.pyplot as plt

from imblearn.over_sampling import SMOTE

from ml_metrics import mapk

from sklearn.preprocessing import OneHotEncoder, LabelEncoder, Normalizer, QuantileTransformer

from sklearn.decomposition import TruncatedSVD

from sklearn.model_selection import train_test_split

from sklearn.linear_model import LogisticRegression

from sklearn.ensemble import RandomForestRegressor, RandomForestClassifier

from sklearn.cluster import MiniBatchKMeans

from sklearn.pipeline import Pipeline

from sklearn.compose import ColumnTransformer

from sklearn.metrics import mean_absolute_error, mean_squared_error, classification_report, accuracy_score, f1_score, precision_score, recall_score, roc_auc_score

%matplotlib inline

sns.set_style('whitegrid')

np.random.seed(42)

2.0 Exploratory Data Analysis

2.1 Load Market Data

%%time

with ZipFile("../data/estaticos_market.csv.zip").open("estaticos_market.csv") as dataset:

market_df = pd.read_csv(dataset, index_col=0)

Wall time: 9.08 s

2.2 Describing Market Database

market_df.info()

<class 'pandas.core.frame.DataFrame'>

Int64Index: 462298 entries, 0 to 462297

Columns: 181 entries, id to qt_filiais

dtypes: bool(9), float64(144), int64(1), object(27)

memory usage: 614.1+ MB

market_df.head()

| id | fl_matriz | de_natureza_juridica | sg_uf | natureza_juridica_macro | de_ramo | setor | idade_empresa_anos | idade_emp_cat | fl_me | ... | media_meses_servicos | max_meses_servicos | min_meses_servicos | qt_funcionarios | qt_funcionarios_12meses | qt_funcionarios_24meses | tx_crescimento_12meses | tx_crescimento_24meses | tx_rotatividade | qt_filiais | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | a6984c3ae395090e3bee8ad63c3758b110de096d5d8195... | True | SOCIEDADE EMPRESARIA LIMITADA | RN | ENTIDADES EMPRESARIAIS | INDUSTRIA DA CONSTRUCAO | CONSTRUÇÃO CIVIL | 14.457534 | 10 a 15 | False | ... | 43.738462 | 93.266667 | 19.166667 | 26.0 | 26.0 | 27.0 | 0.0 | -3.703704 | 0.0 | 0 |

| 1 | 6178f41ade1365e44bc2c46654c2c8c0eaae27dcb476c4... | True | EMPRESARIO INDIVIDUAL | PI | OUTROS | SERVICOS DE ALOJAMENTO/ALIMENTACAO | SERVIÇO | 1.463014 | 1 a 5 | False | ... | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | 0 |

| 2 | 4a7e5069a397f12fdd7fd57111d6dc5d3ba558958efc02... | True | EMPRESARIO INDIVIDUAL | AM | OUTROS | TRANSPORTE, ARMAZENAGEM E CORREIO | SERVIÇO | 7.093151 | 5 a 10 | False | ... | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | 0 |

| 3 | 3348900fe63216a439d2e5238c79ddd46ede454df7b9d8... | True | EMPRESARIO INDIVIDUAL | AM | OUTROS | SERVICOS DIVERSOS | SERVIÇO | 6.512329 | 5 a 10 | False | ... | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | 0 |

| 4 | 1f9bcabc9d3173c1fe769899e4fac14b053037b953a1e4... | True | EMPRESARIO INDIVIDUAL | RN | OUTROS | SERVICOS PROFISSIONAIS, TECNICOS E CIENTIFICOS | SERVIÇO | 3.200000 | 1 a 5 | False | ... | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | 0 |

5 rows × 181 columns

market_df.describe()

| idade_empresa_anos | vl_total_tancagem | vl_total_veiculos_antt | vl_total_veiculos_leves | vl_total_veiculos_pesados | qt_art | vl_total_veiculos_pesados_grupo | vl_total_veiculos_leves_grupo | vl_total_tancagem_grupo | vl_total_veiculos_antt_grupo | ... | media_meses_servicos | max_meses_servicos | min_meses_servicos | qt_funcionarios | qt_funcionarios_12meses | qt_funcionarios_24meses | tx_crescimento_12meses | tx_crescimento_24meses | tx_rotatividade | qt_filiais | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | 462298.000000 | 280.000000 | 176.000000 | 30684.000000 | 30684.000000 | 6590.000000 | 460371.000000 | 460371.000000 | 1760.000000 | 336.000000 | ... | 76261.000000 | 76261.000000 | 76261.000000 | 103574.000000 | 103574.000000 | 103574.000000 | 73888.000000 | 74014.000000 | 103574.000000 | 462298.000000 |

| mean | 9.948677 | 32.014286 | 3.818182 | 2.244329 | 1.177813 | 5.769044 | 3.591801 | 48.699177 | 134.597159 | 15.934524 | ... | 58.060498 | 96.661983 | 36.258851 | 12.324570 | 12.178529 | 14.343329 | 3.097607 | -5.834288 | 9.510699 | 28.737044 |

| std | 9.615664 | 81.280168 | 6.797555 | 9.572536 | 6.589059 | 25.450950 | 72.600352 | 1206.696804 | 683.774506 | 29.708663 | ... | 142.951278 | 279.541243 | 123.411370 | 222.456579 | 222.584458 | 239.885359 | 163.581549 | 443.825819 | 27.918737 | 468.626094 |

| min | 0.016438 | 1.000000 | 0.000000 | 0.000000 | 0.000000 | 1.000000 | 0.000000 | 0.000000 | 1.000000 | 0.000000 | ... | 1.933333 | 1.933333 | 1.933333 | 0.000000 | 0.000000 | 0.000000 | -100.000000 | -100.000000 | 0.000000 | 0.000000 |

| 25% | 2.756164 | 15.000000 | 1.000000 | 0.000000 | 0.000000 | 1.000000 | 0.000000 | 0.000000 | 15.000000 | 1.000000 | ... | 25.203704 | 33.333333 | 6.966667 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | -44.444444 | 0.000000 | 0.000000 |

| 50% | 6.704110 | 15.000000 | 2.000000 | 1.000000 | 0.000000 | 2.000000 | 0.000000 | 0.000000 | 15.000000 | 3.000000 | ... | 43.533333 | 61.766667 | 23.200000 | 2.000000 | 2.000000 | 2.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| 75% | 14.465753 | 30.000000 | 4.000000 | 2.000000 | 1.000000 | 4.000000 | 0.000000 | 0.000000 | 66.250000 | 8.000000 | ... | 68.883333 | 96.266667 | 46.500000 | 5.000000 | 5.000000 | 6.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| max | 106.432877 | 1215.000000 | 50.000000 | 489.000000 | 363.000000 | 1017.000000 | 9782.000000 | 122090.000000 | 11922.000000 | 108.000000 | ... | 5099.066667 | 5099.066667 | 5099.066667 | 51547.000000 | 51547.000000 | 54205.000000 | 27800.000000 | 87300.000000 | 1400.000000 | 9647.000000 |

8 rows × 145 columns

def create_control_df(df):

"""

Create a control dataframe from the input df with information about it's features.

:param df: Pandas DataFrame from which control dataframe will be constructed.

:output: Pandas DataFrame with features as index and columns representing missing values, missing percentage, dtypes, number of unique values, \

and percentage of unique values per number of observations.

"""

control_dict = {"missing": df.isna().sum(),

"missing_percentage": round(100*df.isna().sum()/df.shape[0], 3),

"type": df.dtypes,

"unique": df.nunique(),

"unique_percentage": round(100*df.nunique()/df.shape[0], 4)}

control_df = pd.DataFrame(control_dict)

control_df.index.name = "features"

return control_df

market_control_df = create_control_df(market_df)

market_control_df

| missing | missing_percentage | type | unique | unique_percentage | |

|---|---|---|---|---|---|

| features | |||||

| id | 0 | 0.000 | object | 462298 | 100.0000 |

| fl_matriz | 0 | 0.000 | bool | 2 | 0.0004 |

| de_natureza_juridica | 0 | 0.000 | object | 67 | 0.0145 |

| sg_uf | 0 | 0.000 | object | 6 | 0.0013 |

| natureza_juridica_macro | 0 | 0.000 | object | 7 | 0.0015 |

| ... | ... | ... | ... | ... | ... |

| qt_funcionarios_24meses | 358724 | 77.596 | float64 | 762 | 0.1648 |

| tx_crescimento_12meses | 388410 | 84.017 | float64 | 2237 | 0.4839 |

| tx_crescimento_24meses | 388284 | 83.990 | float64 | 3388 | 0.7329 |

| tx_rotatividade | 358724 | 77.596 | float64 | 2548 | 0.5512 |

| qt_filiais | 0 | 0.000 | int64 | 304 | 0.0658 |

181 rows × 5 columns

print(f"The percentage of missing values in the market dataset is {round(100*(market_df.isna().sum().sum() / market_df.size))} %")

The percentage of missing values in the market dataset is 66 %

market_df.dtypes.value_counts().apply(lambda x: str(x) + " features <-> " + str(round(100*x/market_df.shape[1])) + " %")

float64 144 features <-> 80 %

object 27 features <-> 15 %

bool 9 features <-> 5 %

int64 1 features <-> 1 %

dtype: object

From this data preview, it can be said:

- There’s 66% missing values;

- There’s features with types

float64,object,boolandint. 80% of the features are of typefloat64; - There’s 181 features, counting ID.

- There’s 462298 companies - every ID is unique.

- Observing the description of numeric features, it’s possible to infer that many features present right skewed distributions, with max values way higher than the third quartile (q3=75%). That’s also observable through the means and medians - means are mostly higher than the medians.

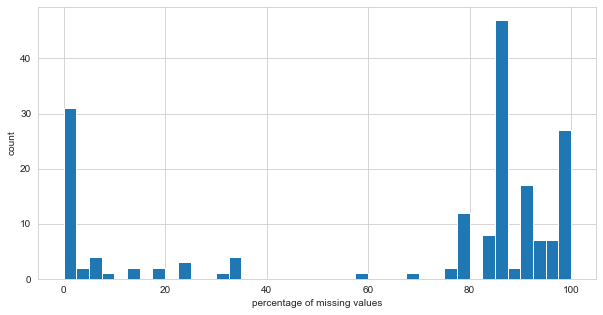

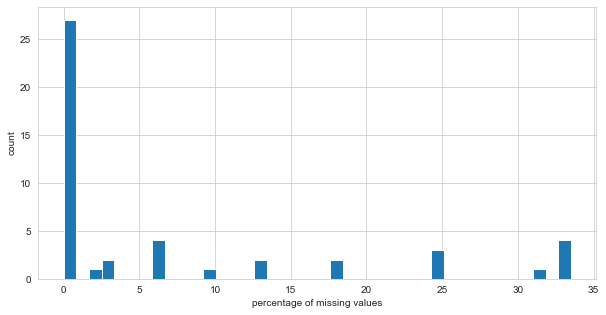

2.3 Defining Missing Values Threshold

The plot below shows that there are several features with missing values.

plt.figure(figsize=(10,5))

sns.distplot(market_control_df["missing_percentage"], kde=False, bins = 40, hist_kws={"alpha":1})

plt.xlabel("percentage of missing values")

plt.ylabel("count");

Below, the output shows that 143 of the features with missing values are of type float64, while 20 of them are of type object.

market_control_df[market_control_df["missing"] != 0]["type"].value_counts()

float64 143

object 20

Name: type, dtype: int64

How many features have a percentage of missing values equal or higher than 50%?

market_control_df[(market_control_df["missing_percentage"] >= 50) & (market_control_df["type"] == "float64")].shape[0]

130

market_control_df[(market_control_df["missing_percentage"] >= 50) & (market_control_df["type"] == "object")].shape[0]

1

130 of the float64 features and 1 object feature have 50% or more missing values. The decision, as a rule of thumb, is to drop these from the market dataset.

columns_to_drop = market_control_df[(market_control_df["missing_percentage"] >= 50)].index

market_df.drop(columns_to_drop, axis=1, inplace=True)

market_control_df = create_control_df(market_df)

print(f"The percentage of missing values in the market dataset is {round(100*(market_df.isna().sum().sum() / market_df.size))} %")

The percentage of missing values in the market dataset is 7 %

Later, the remaining missing values of each type of feature will be addressed.

2.4 Identifying ID and Constant Features

The code below identifies features with a number equal to the number of observations (i.e. behaves as an ID for the companies), and features with constant observations (i.e. all observatios are equal, which will not help any model to generalize predictions/classifications/etc.).

The feature id is the only one that behaves as an identifier to the companies. We’ll assign it to a separate variable called IDs.

The feature fl_epp is the only one that has equal values for each observation, thus it’ll be dropped from the dataset.

id_features = list(market_control_df[market_control_df["unique"] == market_df.shape[0]].index)

constant_features = list(market_control_df[market_control_df["unique"] == 1].index)

print(f"The identifier feature{'s are' if len(id_features) > 1 else ' is'} {id_features}")

print(f"The constant feature{'s are' if len(constant_features) > 1 else ' is'} {constant_features}")

IDs = market_df[id_features]

IDs.columns.name = ''

market_df.drop(constant_features + id_features, axis=1, inplace=True)

market_control_df = create_control_df(market_df)

The identifier feature is ['id']

The constant feature is ['fl_epp']

Below, the unique values for each categorical variable is shown.

The variable dt_situacao has too many classes for a categorical variable, this may cause problems later on while imputing values. The feature dictionary indicates that it represents dates when “de_situacao” was registered by the IRS, but it has no more references to “de_situacao”, so we’ll just drop it.

market_control_df.loc[(market_control_df["type"] == "object") | (market_control_df["type"] == "bool"), "unique"].sort_values(ascending=False).head()

features

dt_situacao 7334

nm_divisao 87

nm_micro_regiao 73

de_natureza_juridica 67

de_ramo 33

Name: unique, dtype: int64

market_df.drop("dt_situacao", axis=1, inplace=True)

market_control_df.loc[(market_control_df["type"] == "float64") | (market_control_df["type"] == "int64"), "unique"].sort_values(ascending=False)

features

empsetorcensitariofaixarendapopulacao 15419

idade_empresa_anos 14198

vl_faturamento_estimado_grupo_aux 6794

vl_faturamento_estimado_aux 1920

idade_media_socios 1010

vl_total_veiculos_leves_grupo 310

qt_filiais 304

vl_total_veiculos_pesados_grupo 296

idade_maxima_socios 118

idade_minima_socios 114

qt_socios_pf 64

qt_socios 62

qt_socios_st_regular 54

nu_meses_rescencia 51

qt_socios_pj 12

Name: unique, dtype: int64

2.5 Verifying Features’ Types

Next, we’ll evaluate the features’ characteristics, modify their types as necessary, and create lists with features’ names by type.

market_control_df = create_control_df(market_df)

2.5.1 Float Features

market_control_df[market_control_df["type"] == "float64"]

| missing | missing_percentage | type | unique | unique_percentage | |

|---|---|---|---|---|---|

| features | |||||

| idade_empresa_anos | 0 | 0.000 | float64 | 14198 | 3.0712 |

| vl_total_veiculos_pesados_grupo | 1927 | 0.417 | float64 | 296 | 0.0640 |

| vl_total_veiculos_leves_grupo | 1927 | 0.417 | float64 | 310 | 0.0671 |

| nu_meses_rescencia | 45276 | 9.794 | float64 | 51 | 0.0110 |

| empsetorcensitariofaixarendapopulacao | 143829 | 31.112 | float64 | 15419 | 3.3353 |

| qt_socios | 115091 | 24.895 | float64 | 62 | 0.0134 |

| qt_socios_pf | 115091 | 24.895 | float64 | 64 | 0.0138 |

| qt_socios_pj | 115091 | 24.895 | float64 | 12 | 0.0026 |

| idade_media_socios | 151602 | 32.793 | float64 | 1010 | 0.2185 |

| idade_maxima_socios | 151602 | 32.793 | float64 | 118 | 0.0255 |

| idade_minima_socios | 151602 | 32.793 | float64 | 114 | 0.0247 |

| qt_socios_st_regular | 154917 | 33.510 | float64 | 54 | 0.0117 |

| vl_faturamento_estimado_aux | 27513 | 5.951 | float64 | 1920 | 0.4153 |

| vl_faturamento_estimado_grupo_aux | 27513 | 5.951 | float64 | 6794 | 1.4696 |

The code below assigns the names of float features to the list float_features, and the names if float features with missing values to float_features_with_missing. It also creates a table describing the float features.

Checking their mean and median values through the next table, it’s possible to infer that their distributions are right skewed (overall, means > medians).

Also, the features idade_media_socios, idade_maxima_socios, idade_minima_socios, which represent ages, have negative minimum values.

float_features = list(market_control_df[market_control_df["type"] == "float64"].index)

float_features_with_missing = float_features.copy()

float_features_with_missing.remove("idade_empresa_anos")

market_df[float_features].describe()

| features | idade_empresa_anos | vl_total_veiculos_pesados_grupo | vl_total_veiculos_leves_grupo | nu_meses_rescencia | empsetorcensitariofaixarendapopulacao | qt_socios | qt_socios_pf | qt_socios_pj | idade_media_socios | idade_maxima_socios | idade_minima_socios | qt_socios_st_regular | vl_faturamento_estimado_aux | vl_faturamento_estimado_grupo_aux |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | 462298.000000 | 460371.000000 | 460371.000000 | 417022.000000 | 318469.000000 | 347207.000000 | 347207.000000 | 347207.000000 | 310696.000000 | 310696.000000 | 310696.000000 | 307381.000000 | 4.347850e+05 | 4.347850e+05 |

| mean | 9.948677 | 3.591801 | 48.699177 | 25.007247 | 1308.005725 | 1.496326 | 1.476681 | 0.019645 | 42.816452 | 44.344131 | 41.355225 | 1.396082 | 8.020911e+05 | 3.367205e+08 |

| std | 9.615664 | 72.600352 | 1206.696804 | 9.679799 | 1161.889222 | 3.276626 | 3.258079 | 0.195166 | 12.626447 | 13.930385 | 12.514921 | 2.578793 | 3.099979e+07 | 7.114614e+09 |

| min | 0.016438 | 0.000000 | 0.000000 | 0.000000 | 100.000000 | 1.000000 | 0.000000 | 0.000000 | -2.000000 | -2.000000 | -2.000000 | 1.000000 | 0.000000e+00 | 4.104703e+04 |

| 25% | 2.756164 | 0.000000 | 0.000000 | 22.000000 | 673.230000 | 1.000000 | 1.000000 | 0.000000 | 33.000000 | 34.000000 | 32.000000 | 1.000000 | 1.648512e+05 | 1.854576e+05 |

| 50% | 6.704110 | 0.000000 | 0.000000 | 23.000000 | 946.680000 | 1.000000 | 1.000000 | 0.000000 | 42.000000 | 43.000000 | 40.000000 | 1.000000 | 2.100000e+05 | 2.100000e+05 |

| 75% | 14.465753 | 0.000000 | 0.000000 | 25.000000 | 1518.080000 | 2.000000 | 2.000000 | 0.000000 | 51.000000 | 54.000000 | 50.000000 | 1.000000 | 2.100000e+05 | 2.100000e+05 |

| max | 106.432877 | 9782.000000 | 122090.000000 | 66.000000 | 75093.840000 | 246.000000 | 246.000000 | 13.000000 | 127.000000 | 127.000000 | 127.000000 | 179.000000 | 1.454662e+10 | 2.227618e+11 |

def create_distplots(df, features):

"""

Shows a grid with subplots containing the distribution plots for every feature in the list.

:param df: Pandas DataFrame containing the data.

:param features: list or similar containing the continuous numeric features names.

"""

if len(features) == 1:

plt.figure(figsize=(20, 4.3))

sns.distplot(df[features[0]], hist_kws={"alpha":1}, kde=False)

plt.xlabel(features[0])

plt.ylabel("count")

else:

nrows = len(features)//2

ncols = 2

n_figures = len(features)-1

if len(features) % 2 != 0:

nrows += 1

fig, axs = plt.subplots(nrows=nrows, ncols=ncols, figsize=(20, nrows*4.3))

flag = 0

while flag <= n_figures:

for pos_row in range(nrows):

for pos_col in range(ncols):

if nrows == 1:

ax = axs[pos_col]

else:

ax = axs[pos_row, pos_col]

if (len(features)%2 != 0) and (pos_row == nrows-1) and (pos_col == 1):

flag+=1

continue

sns.distplot(df[features[flag]], ax=ax, hist_kws={"alpha":1}, kde=False)

plt.xlabel(features[flag])

plt.ylabel("count")

flag+=1

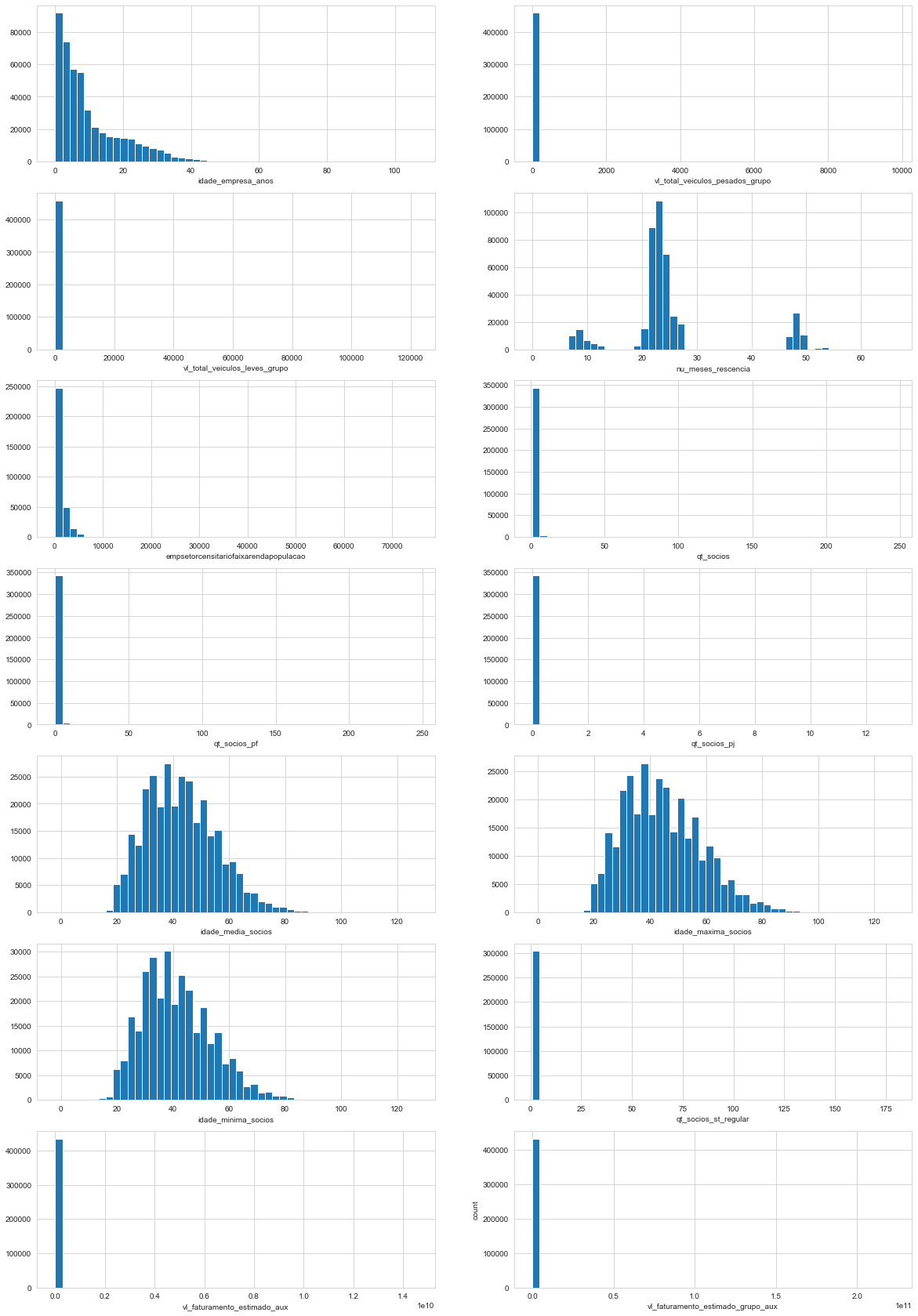

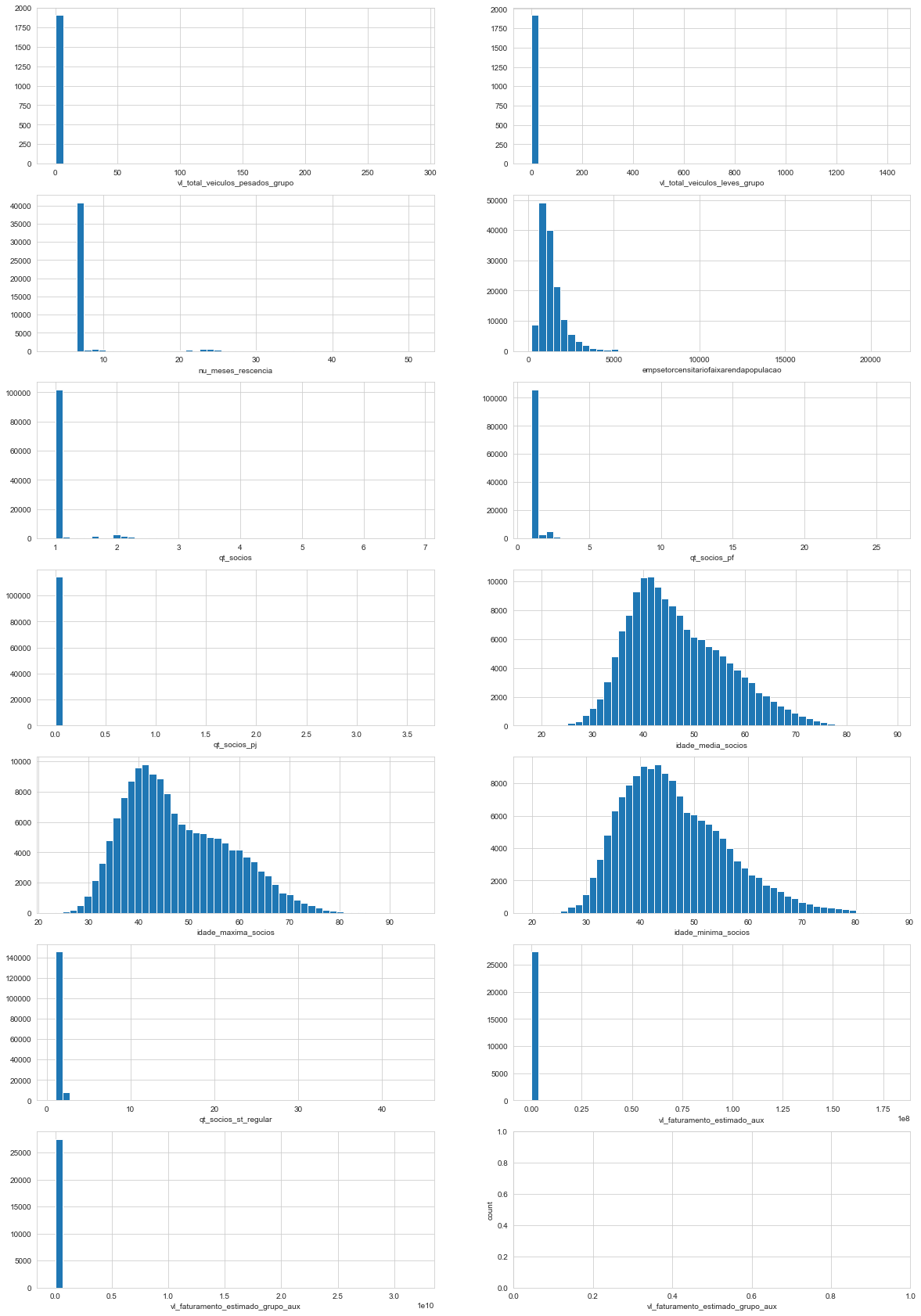

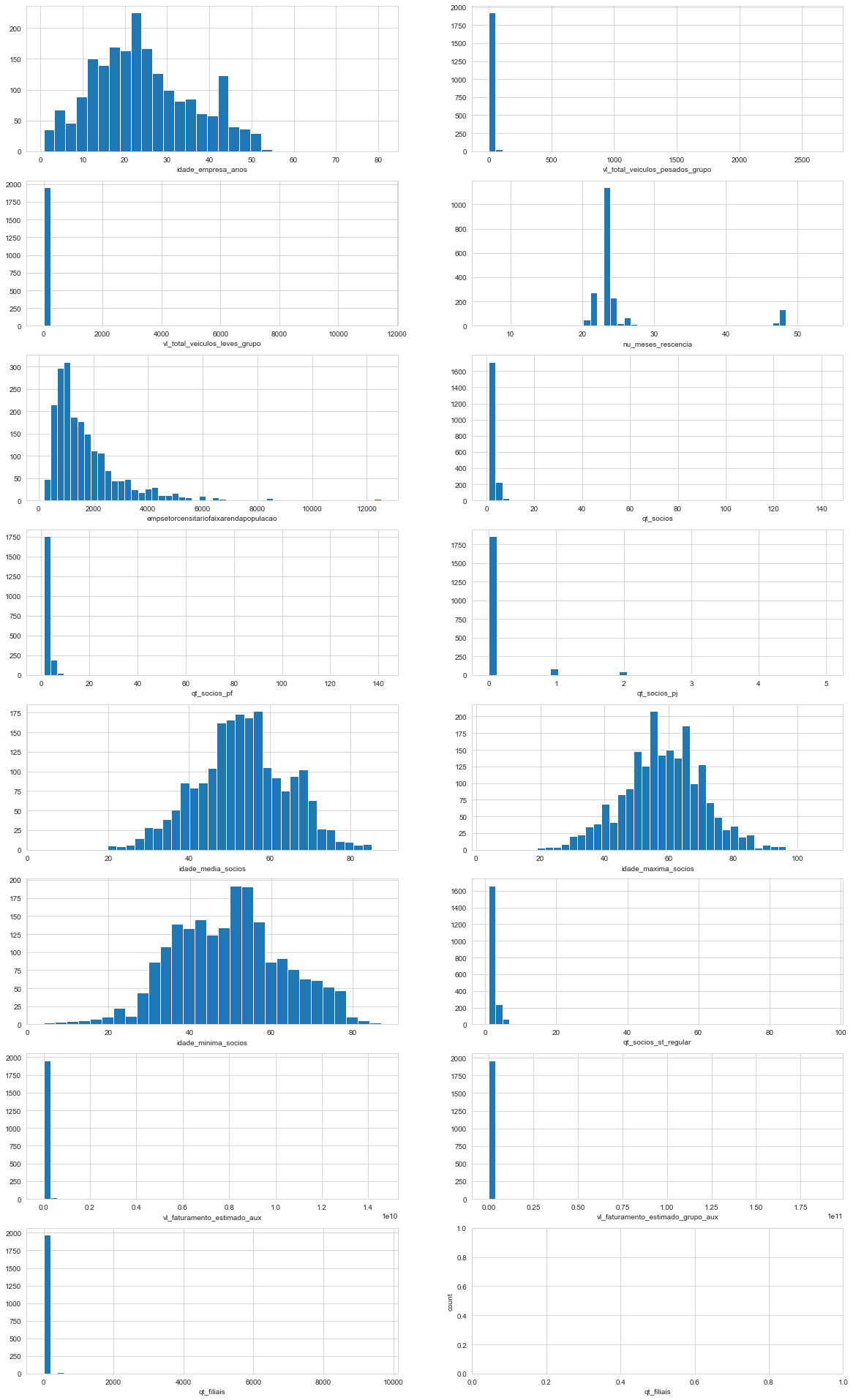

create_distplots(market_df, float_features)

Through the graphics and tables above it’s possible to infer:

- we confirm that the distributions are right skewed. Some have most values grouped together near 0.

- Observing the x axis, it’s possible to infer that some features present very extreme values.

- The feature

nu_meses_rescenciadraws attention to it’s three peaks, it’s a multimodal distribution. - The features

idade_media_socios,idade_maxima_socios,idade_minima_sociosmay be represented by a log-normal distribution. - Some present missing values.

Since idade_media_socios, idade_maxima_socios, idade_minima_socios represent people ages it should not have negative values. In the next code block we change the negative values to the most common values under 20, which seems like a good threshold considering the graphics.

age_features = "idade_media_socios, idade_maxima_socios, idade_minima_socios".split(", ")

for feature in age_features:

most_common_under_20 = market_df.loc[market_df[feature] <= 20, feature].value_counts().idxmax()

print(f"{feature} most common under 20:\n{most_common_under_20}\n")

market_df.loc[market_df[feature] <= 0, feature] = most_common_under_20

idade_media_socios most common under 20:

20.0

idade_maxima_socios most common under 20:

20.0

idade_minima_socios most common under 20:

20.0

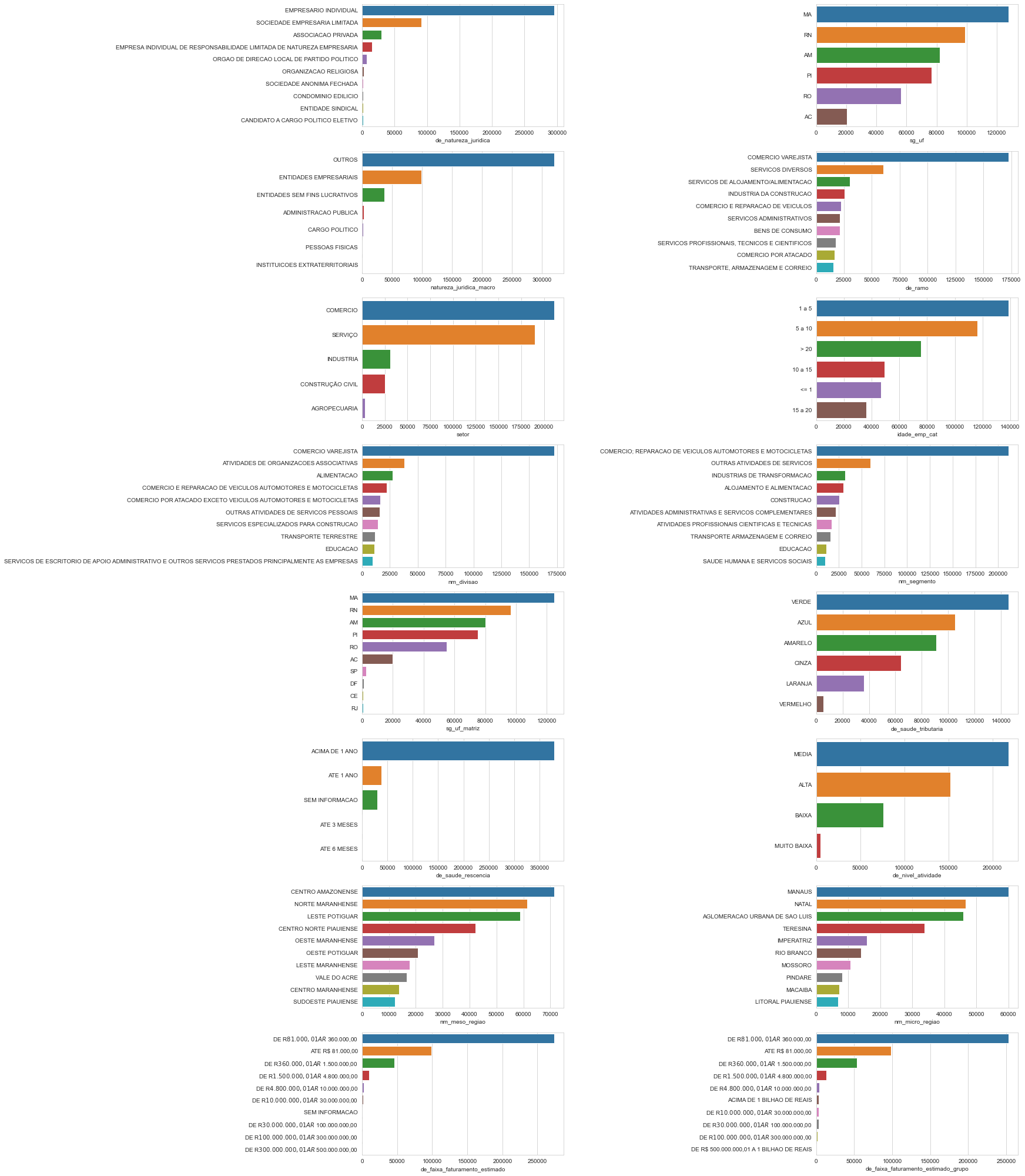

2.5.2 Integer Features

market_control_df[market_control_df["type"] == "int64"]

| missing | missing_percentage | type | unique | unique_percentage | |

|---|---|---|---|---|---|

| features | |||||

| qt_filiais | 0 | 0.0 | int64 | 304 | 0.0658 |

The code below assigns the name of integer features to the integer_features list. It also creates a table describing the feature.

It’s possible to infer that it’s distributions is right skewed (overall, means > medians), much like the float features observed.

There are no missing values in the feature.

integer_features = list(market_control_df[market_control_df["type"] == "int64"].index)

market_df[integer_features].describe()

| features | qt_filiais |

|---|---|

| count | 462298.000000 |

| mean | 28.737044 |

| std | 468.626094 |

| min | 0.000000 |

| 25% | 0.000000 |

| 50% | 0.000000 |

| 75% | 0.000000 |

| max | 9647.000000 |

create_distplots(market_df, integer_features)

2.5.3 Categorical Features

market_control_df[(market_control_df["type"] == "object") | (market_control_df["type"] == "bool")]

| missing | missing_percentage | type | unique | unique_percentage | |

|---|---|---|---|---|---|

| features | |||||

| fl_matriz | 0 | 0.000 | bool | 2 | 0.0004 |

| de_natureza_juridica | 0 | 0.000 | object | 67 | 0.0145 |

| sg_uf | 0 | 0.000 | object | 6 | 0.0013 |

| natureza_juridica_macro | 0 | 0.000 | object | 7 | 0.0015 |

| de_ramo | 0 | 0.000 | object | 33 | 0.0071 |

| setor | 1927 | 0.417 | object | 5 | 0.0011 |

| idade_emp_cat | 0 | 0.000 | object | 6 | 0.0013 |

| fl_me | 0 | 0.000 | bool | 2 | 0.0004 |

| fl_sa | 0 | 0.000 | bool | 2 | 0.0004 |

| fl_mei | 0 | 0.000 | bool | 2 | 0.0004 |

| fl_ltda | 0 | 0.000 | bool | 2 | 0.0004 |

| fl_st_especial | 0 | 0.000 | bool | 2 | 0.0004 |

| fl_email | 0 | 0.000 | bool | 2 | 0.0004 |

| fl_telefone | 0 | 0.000 | bool | 2 | 0.0004 |

| fl_rm | 0 | 0.000 | object | 2 | 0.0004 |

| nm_divisao | 1927 | 0.417 | object | 87 | 0.0188 |

| nm_segmento | 1927 | 0.417 | object | 21 | 0.0045 |

| fl_spa | 1927 | 0.417 | object | 2 | 0.0004 |

| fl_antt | 1927 | 0.417 | object | 2 | 0.0004 |

| fl_veiculo | 1927 | 0.417 | object | 2 | 0.0004 |

| fl_optante_simples | 82713 | 17.892 | object | 2 | 0.0004 |

| fl_optante_simei | 82713 | 17.892 | object | 2 | 0.0004 |

| sg_uf_matriz | 1939 | 0.419 | object | 27 | 0.0058 |

| de_saude_tributaria | 14851 | 3.212 | object | 6 | 0.0013 |

| de_saude_rescencia | 14851 | 3.212 | object | 5 | 0.0011 |

| de_nivel_atividade | 11168 | 2.416 | object | 4 | 0.0009 |

| fl_simples_irregular | 1927 | 0.417 | object | 2 | 0.0004 |

| nm_meso_regiao | 58698 | 12.697 | object | 19 | 0.0041 |

| nm_micro_regiao | 58698 | 12.697 | object | 73 | 0.0158 |

| fl_passivel_iss | 1927 | 0.417 | object | 2 | 0.0004 |

| de_faixa_faturamento_estimado | 27513 | 5.951 | object | 12 | 0.0026 |

| de_faixa_faturamento_estimado_grupo | 27513 | 5.951 | object | 11 | 0.0024 |

The table above shows that some features of type object have only two unique values. Usually, this is associated with boolean features. In the next code block we take a closer look and confirm that these are all actually boolean features. Their names’ are stored in the boolean_features list, along with the features that were already of type bool, and the names of the boolean features with missing values are stored in boolean_features_with_missing.

boolean_features = list(market_control_df[

((market_control_df["type"] == "object") | (market_control_df["type"] == "bool"))

& (market_control_df["unique"] == 2)].index)

boolean_features_with_missing = list(market_control_df[

((market_control_df["type"] == "object") | (market_control_df["type"] == "bool"))

& (market_control_df["unique"] == 2) & (market_control_df["missing"] != 0)].index)

market_df[boolean_features].describe()

| features | fl_matriz | fl_me | fl_sa | fl_mei | fl_ltda | fl_st_especial | fl_email | fl_telefone | fl_rm | fl_spa | fl_antt | fl_veiculo | fl_optante_simples | fl_optante_simei | fl_simples_irregular | fl_passivel_iss |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | 462298 | 462298 | 462298 | 462298 | 462298 | 462298 | 462298 | 462298 | 462298 | 460371 | 460371 | 460371 | 379585 | 379585 | 460371 | 460371 |

| unique | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 |

| top | True | False | False | False | False | False | False | True | NAO | False | False | False | True | False | False | True |

| freq | 433232 | 461083 | 453866 | 311398 | 461056 | 462230 | 256228 | 335468 | 236779 | 460091 | 457095 | 429687 | 199617 | 285545 | 460030 | 264741 |

The boolean feature fl_rm is of type object and presents the top value as “NAO” (“NO” in portuguese). We’ll transform this and the other boolean features into 0s and 1s.

temp_onehot = OneHotEncoder(drop="if_binary", sparse=False, dtype=np.float)

market_df.loc[:, "fl_rm"] = temp_onehot.fit_transform(market_df[["fl_rm"]])

market_df.loc[:, boolean_features] = market_df[boolean_features].astype(np.float)

market_df[boolean_features].describe()

| features | fl_matriz | fl_me | fl_sa | fl_mei | fl_ltda | fl_st_especial | fl_email | fl_telefone | fl_rm | fl_spa | fl_antt | fl_veiculo | fl_optante_simples | fl_optante_simei | fl_simples_irregular | fl_passivel_iss |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | 462298.000000 | 462298.000000 | 462298.000000 | 462298.000000 | 462298.000000 | 462298.000000 | 462298.000000 | 462298.000000 | 462298.000000 | 460371.000000 | 460371.000000 | 460371.000000 | 379585.000000 | 379585.000000 | 460371.000000 | 460371.000000 |

| mean | 0.937127 | 0.002628 | 0.018239 | 0.326413 | 0.002687 | 0.000147 | 0.445751 | 0.725653 | 0.487822 | 0.000608 | 0.007116 | 0.066651 | 0.525882 | 0.247744 | 0.000741 | 0.575060 |

| std | 0.242734 | 0.051198 | 0.133816 | 0.468901 | 0.051763 | 0.012127 | 0.497049 | 0.446185 | 0.499852 | 0.024654 | 0.084056 | 0.249416 | 0.499330 | 0.431703 | 0.027206 | 0.494334 |

| min | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| 25% | 1.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| 50% | 1.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 1.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 1.000000 | 0.000000 | 0.000000 | 1.000000 |

| 75% | 1.000000 | 0.000000 | 0.000000 | 1.000000 | 0.000000 | 0.000000 | 1.000000 | 1.000000 | 1.000000 | 0.000000 | 0.000000 | 0.000000 | 1.000000 | 0.000000 | 0.000000 | 1.000000 |

| max | 1.000000 | 1.000000 | 1.000000 | 1.000000 | 1.000000 | 1.000000 | 1.000000 | 1.000000 | 1.000000 | 1.000000 | 1.000000 | 1.000000 | 1.000000 | 1.000000 | 1.000000 | 1.000000 |

The remaining object features are described in the table below. Their names are stored as object_features, and the object features that have missing values are assigned to object_features_with_missing.

object_features = list(market_control_df[

(market_control_df["type"] == "object") & (market_control_df["unique"] > 2)

].index)

object_features_with_missing = list(market_control_df[

(market_control_df["type"] == "object") & (market_control_df["unique"] > 2) & (market_control_df["missing"] != 0)].index)

market_df[object_features].describe().T

| count | unique | top | freq | |

|---|---|---|---|---|

| features | ||||

| de_natureza_juridica | 462298 | 67 | EMPRESARIO INDIVIDUAL | 295756 |

| sg_uf | 462298 | 6 | MA | 127654 |

| natureza_juridica_macro | 462298 | 7 | OUTROS | 320211 |

| de_ramo | 462298 | 33 | COMERCIO VAREJISTA | 172404 |

| setor | 460371 | 5 | COMERCIO | 211224 |

| idade_emp_cat | 462298 | 6 | 1 a 5 | 138580 |

| nm_divisao | 460371 | 87 | COMERCIO VAREJISTA | 172404 |

| nm_segmento | 460371 | 21 | COMERCIO; REPARACAO DE VEICULOS AUTOMOTORES E ... | 211224 |

| sg_uf_matriz | 460359 | 27 | MA | 124823 |

| de_saude_tributaria | 447447 | 6 | VERDE | 145430 |

| de_saude_rescencia | 447447 | 5 | ACIMA DE 1 ANO | 378896 |

| de_nivel_atividade | 451130 | 4 | MEDIA | 217949 |

| nm_meso_regiao | 403600 | 19 | CENTRO AMAZONENSE | 71469 |

| nm_micro_regiao | 403600 | 73 | MANAUS | 60008 |

| de_faixa_faturamento_estimado | 434785 | 12 | DE R$ 81.000,01 A R$ 360.000,00 | 273861 |

| de_faixa_faturamento_estimado_grupo | 434785 | 11 | DE R$ 81.000,01 A R$ 360.000,00 | 252602 |

def create_barplots(df, features, n_labels=None):

"""

Shows a grid with subplots containing barplots for every feature in the list.

:param df: Pandas DataFrame containing the data.

:param features: list or similar containing the categorical features names.

:param n_labels: integer, representes number of features' labels to plot. Uses the n features with more counts in descending order.

"""

if len(features) == 1:

x = df[features].value_counts().head(n_labels)

y = x.index

plt.figure(figsize = (25, 4.3))

sns.barplot(x = x, y = y)

plt.xlabel(features[0])

else:

n_figures = len(features) - 1

nrows = len(features)//2

ncols = 2

if len(features) % 2 != 0:

nrows += 1

fig, axs = plt.subplots(nrows=nrows, ncols=ncols, figsize=(20, nrows*4.5))

plt.subplots_adjust(wspace=1.25)

flag = 0

while flag <= n_figures:

for pos_row in range(nrows):

for pos_col in range(ncols):

if nrows == 1:

ax = axs[pos_col]

else:

ax = axs[pos_row, pos_col]

if (len(features)%2 != 0) and (pos_row == nrows-1) and (pos_col == 1):

flag+=1

continue

x = df[features[flag]].value_counts().head(n_labels)

y = x.index

sns.barplot(x=x, y=y, ax=ax)

plt.xlabel(features[flag])

flag+=1

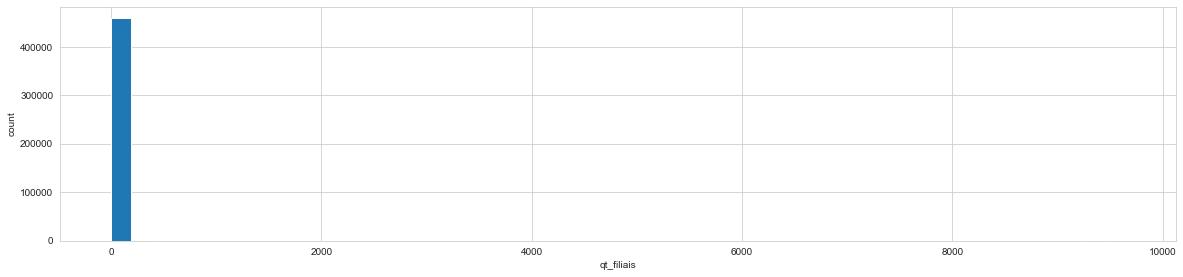

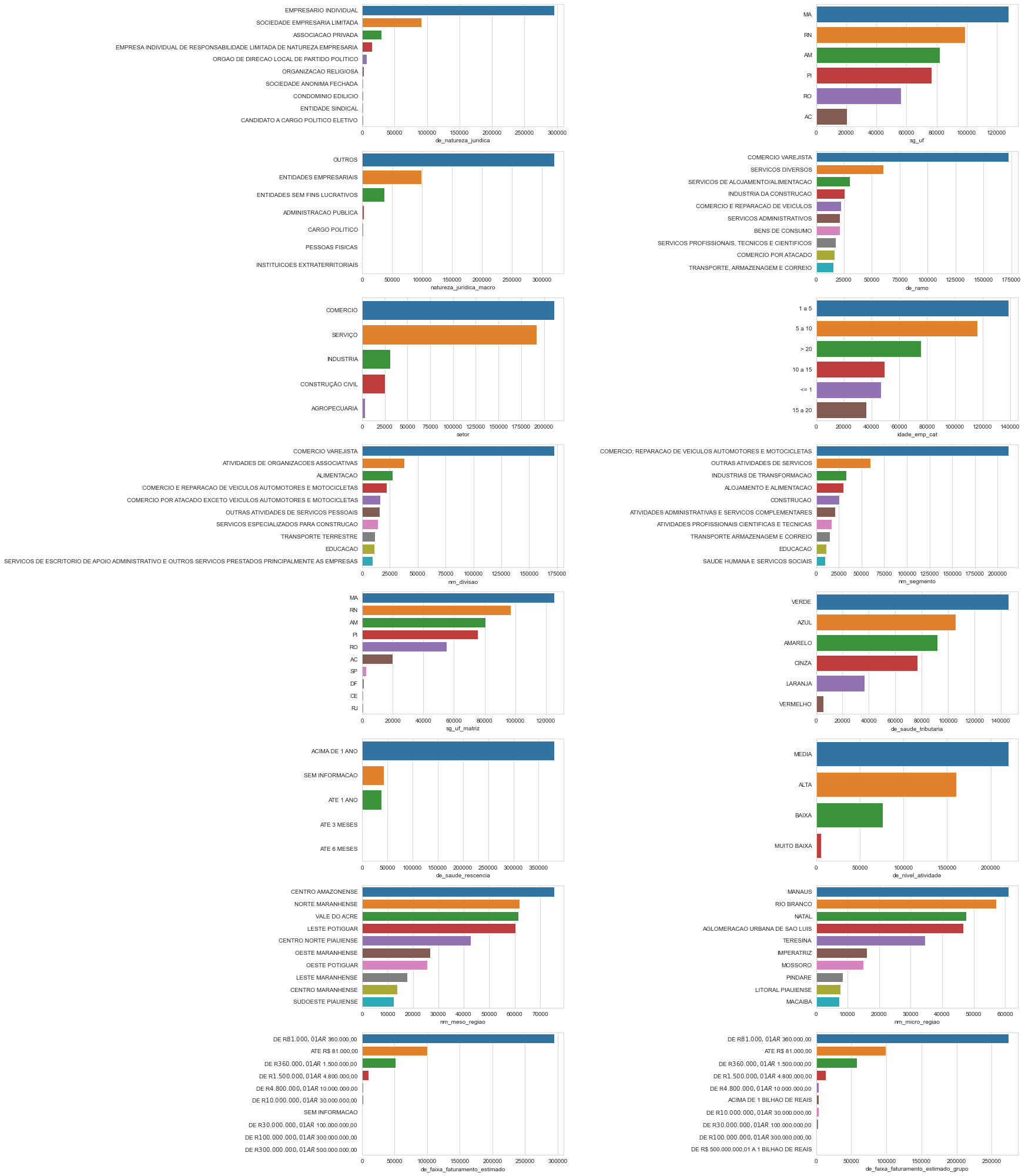

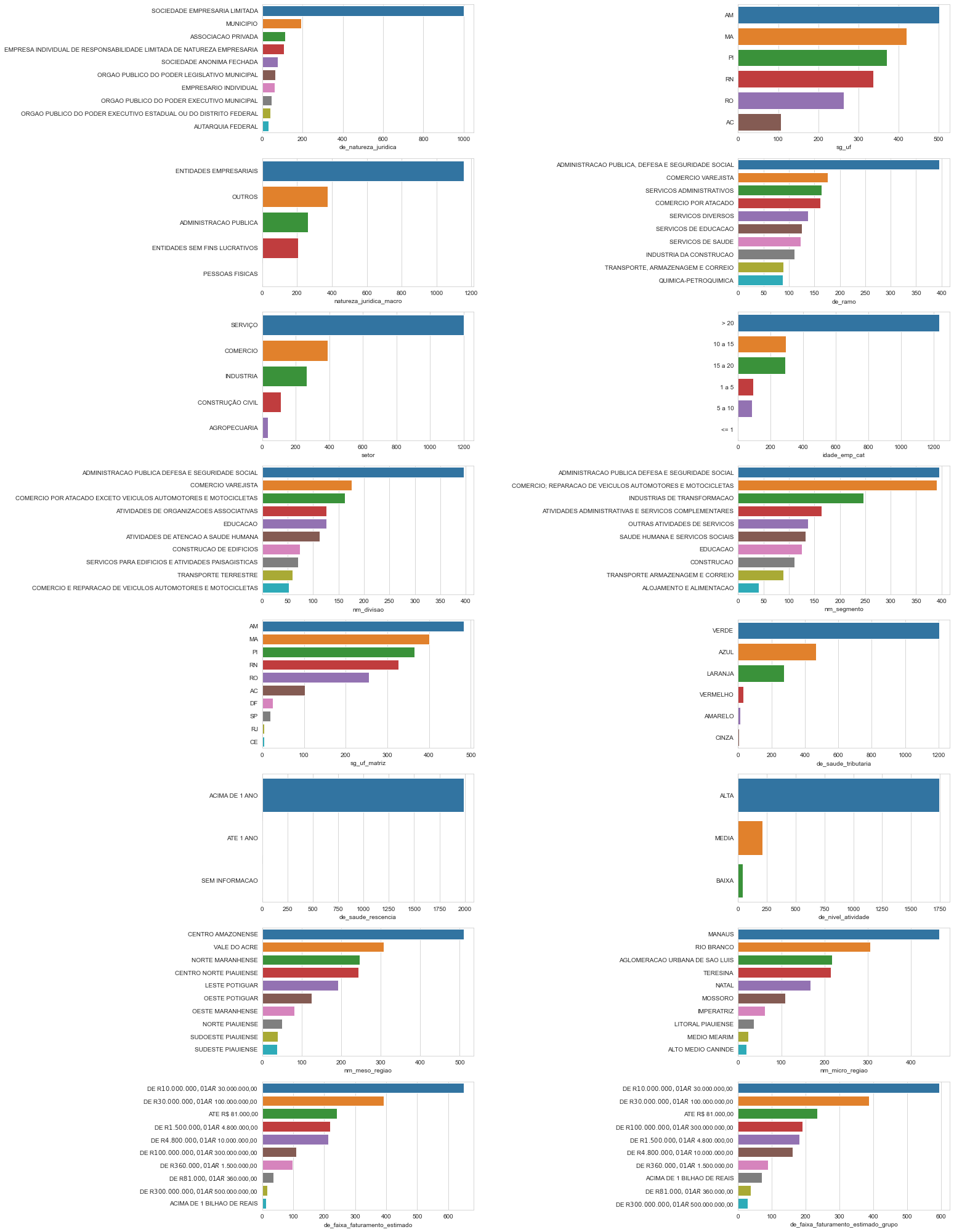

create_barplots(market_df, object_features, n_labels=10)

2.6 Imputing Missing Values

Below, it can be seen through the graphic that some remaining features have at least around 35% missing values or less.

market_control_df = create_control_df(market_df)

plt.figure(figsize=(10,5))

sns.distplot(market_control_df["missing_percentage"], kde=False, bins = 40, hist_kws={"alpha":1})

plt.xlabel("percentage of missing values")

plt.ylabel("count");

The next output shows that from the remaining 31 features with missing values, 20 are of type float64, while 11 of them are of type object. Remember that the boolean features were turned into the type float, but they should be treated as categorical.

print(f"From the {market_control_df.shape[0]} remaining features, {market_control_df[market_control_df['missing'] !=0 ].shape[0]} have missing values.")

print(f"\nTheir types are:\n{market_control_df[market_control_df['missing'] != 0]['type'].value_counts()}")

From the 47 remaining features, 31 have missing values.

Their types are:

float64 20

object 11

Name: type, dtype: int64

2.6.1 Missing Values of Numeric Features

The folowing table shows the remaining float64 features and their respective count and percentage of missing values.

market_control_df[(market_control_df["type"] == "float64")].sort_values(by="missing", ascending=False)

| missing | missing_percentage | type | unique | unique_percentage | |

|---|---|---|---|---|---|

| features | |||||

| qt_socios_st_regular | 154917 | 33.510 | float64 | 54 | 0.0117 |

| idade_minima_socios | 151602 | 32.793 | float64 | 113 | 0.0244 |

| idade_maxima_socios | 151602 | 32.793 | float64 | 117 | 0.0253 |

| idade_media_socios | 151602 | 32.793 | float64 | 1009 | 0.2183 |

| empsetorcensitariofaixarendapopulacao | 143829 | 31.112 | float64 | 15419 | 3.3353 |

| qt_socios_pj | 115091 | 24.895 | float64 | 12 | 0.0026 |

| qt_socios_pf | 115091 | 24.895 | float64 | 64 | 0.0138 |

| qt_socios | 115091 | 24.895 | float64 | 62 | 0.0134 |

| fl_optante_simei | 82713 | 17.892 | float64 | 2 | 0.0004 |

| fl_optante_simples | 82713 | 17.892 | float64 | 2 | 0.0004 |

| nu_meses_rescencia | 45276 | 9.794 | float64 | 51 | 0.0110 |

| vl_faturamento_estimado_grupo_aux | 27513 | 5.951 | float64 | 6794 | 1.4696 |

| vl_faturamento_estimado_aux | 27513 | 5.951 | float64 | 1920 | 0.4153 |

| fl_passivel_iss | 1927 | 0.417 | float64 | 2 | 0.0004 |

| fl_simples_irregular | 1927 | 0.417 | float64 | 2 | 0.0004 |

| vl_total_veiculos_leves_grupo | 1927 | 0.417 | float64 | 310 | 0.0671 |

| vl_total_veiculos_pesados_grupo | 1927 | 0.417 | float64 | 296 | 0.0640 |

| fl_veiculo | 1927 | 0.417 | float64 | 2 | 0.0004 |

| fl_antt | 1927 | 0.417 | float64 | 2 | 0.0004 |

| fl_spa | 1927 | 0.417 | float64 | 2 | 0.0004 |

| idade_empresa_anos | 0 | 0.000 | float64 | 14198 | 3.0712 |

| fl_rm | 0 | 0.000 | float64 | 2 | 0.0004 |

| fl_telefone | 0 | 0.000 | float64 | 2 | 0.0004 |

| fl_email | 0 | 0.000 | float64 | 2 | 0.0004 |

| fl_st_especial | 0 | 0.000 | float64 | 2 | 0.0004 |

| fl_ltda | 0 | 0.000 | float64 | 2 | 0.0004 |

| fl_mei | 0 | 0.000 | float64 | 2 | 0.0004 |

| fl_sa | 0 | 0.000 | float64 | 2 | 0.0004 |

| fl_me | 0 | 0.000 | float64 | 2 | 0.0004 |

| fl_matriz | 0 | 0.000 | float64 | 2 | 0.0004 |

The next code block presents a function to create vectors of values to impute in the features with missing values.

To estimate them, the features that do not have any missing values are used. Random Forests is used as regressor.

def impute_value_generator(df, targets, numeric_predictors, categorical_predictors, target_type="numeric", sample_size=5000):

"""

Create a dictionary with each target feature as key. Each feature dictionary has, in turn, keys for the values created to impute the missing values\n

from the feature, and keys for the metrics generated. It can be used for numeric or categorical targets, and the sample size can be selected to improve\n

iteration speed.

:param df: Pandas DataFrame that contains the data from the targets and predictors.

:param targets: list or similiar, contains the names of the features for which the values will be created and appended to the output dictionary.

:param numeric_predictors: list or similar, contains the names of the numeric features that will be used to predict/classify the missing values. \n

The predictors shouldn't contain missing values.

:param categorical_predictors: list or similar, contains the names of the categorical features that will be used to predict/classify the missing values. \n

The predictors shouldn't contain missing values.

:param target_type: string, accepts the values "numeric" and "categorical". It's used to select the pipeline to be applied - regresion or classification.

:param sample_size: integer, represents the sample size used by the function. It's used to reduce the number of observations used by the function\n

thus speeding the iterations.

:return: A dictionary which contains keys for each target. These have, in turn, keys for the impute values and for the metrics generated.

"""

output = {}

for target in targets:

print(f"Executing iteration for {target}")

# Sciki-learn pipeline and column transformer

cat_pipeline = Pipeline(steps=[

("onehot", OneHotEncoder(handle_unknown="ignore"))

])

num_pipeline = Pipeline(steps=[

("scaler", QuantileTransformer()) # Normalizer, QuantileTransformer

])

transformer = ColumnTransformer(transformers=[

("categorical", cat_pipeline, categorical_predictors),

("numeric", num_pipeline, numeric_predictors)

])

if target_type == "numeric":

pipeline = Pipeline(steps=[

("transformer", transformer),

("regressor", RandomForestRegressor(n_jobs=-1))

])

elif target_type == "categorical":

pipeline = Pipeline(steps=[

("transformer", transformer),

("classifier", RandomForestClassifier(n_jobs=-1))

])

else:

raise Exception("'target_type' must be either 'numeric' or 'categorical'")

sample_features = numeric_predictors + categorical_predictors

# Getting observations without missing values

sample_df = df.loc[~df[target].isna(), sample_features + [target]].reset_index(drop=True)

# Getting another sample of inferior size to speed up training. The indexes are chosen at random.

idx = np.random.choice(len(sample_df), size=sample_size, replace=False)

# Target and predictor assignment

X = sample_df.drop(target, axis=1).iloc[idx]

y = sample_df[target].iloc[idx]

if target_type == "categorical":

label_encoder = LabelEncoder()

y = label_encoder.fit_transform(y)

# Train test split

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size=0.2, random_state=0)

# Fit the model and predict for test set

pipeline.fit(X_train, y_train)

prediction = pipeline.predict(X_test)

# Create variables to impute the missing values. The length of the created vector is equal to the number of missing values in the target

# Getting a sample from the observations where the target variable is missing

target_missing_sample = df.loc[df[target].isna(), sample_features].reset_index(drop=True)

impute_variables = pipeline.predict(target_missing_sample)

# Save created values, evaluate the prediction/classification for each feature, and save metrics

if target_type == "numeric":

output.update({target: {

"impute_variables": impute_variables,

"mean_absolute_error": mean_absolute_error(prediction, y_test).round(2),

"root_mean_squared_error": np.sqrt(mean_squared_error(prediction, y_test)).round(2),

"pipeline": pipeline

}})

print(f"Metrics:\nmean absolute error: {output[target]['mean_absolute_error']}\n\

root mean squared error: {output[target]['root_mean_squared_error']}")

print(169*"-")

elif target_type == "categorical":

output.update({target: {

"impute_variables": impute_variables,

"accuracy_score": accuracy_score(prediction, y_test).round(2),

"f1_score": f1_score(prediction, y_test, average="weighted").round(2),

"classification_report": classification_report(prediction, y_test, zero_division=0),

"pipeline": pipeline,

"label_encoder": label_encoder

}})

print(f"Metrics:\naccuracy: {output[target]['accuracy_score']}\n\

Weighted F1 score: {output[target]['f1_score']}")

print(169*"-")

return output

market_df_copy = market_df.copy() # making copy to prevent messing up the original dataset too much

# defining lists with the names of features without missing values.

object_features_without_missing = [feature for feature in object_features if (feature not in object_features_with_missing)]

boolean_features_without_missing = [feature for feature in boolean_features if (feature not in boolean_features_with_missing)]

float_features_without_missing = [feature for feature in float_features if (feature not in float_features_with_missing)]

# integer_features is already defined and it doesn't containt missing values

numeric_features_without_missing = float_features_without_missing + integer_features

categorical_features_without_missing = object_features_without_missing + boolean_features_without_missing

# defining lists with the names numeric and categorical features.

numeric_features = float_features + integer_features

categorical_features = object_features + boolean_features

print(f"Numeric features without missing values:\n{numeric_features_without_missing}\n\

Categorical features without missing values:\n{categorical_features_without_missing}\n")

Numeric features without missing values:

['idade_empresa_anos', 'qt_filiais']

Categorical features without missing values:

['de_natureza_juridica', 'sg_uf', 'natureza_juridica_macro', 'de_ramo', 'idade_emp_cat', 'fl_matriz', 'fl_me', 'fl_sa', 'fl_mei', 'fl_ltda', 'fl_st_especial', 'fl_email', 'fl_telefone', 'fl_rm']

Below, the function is applied to the numeric features, and generates values to be imputed. The features used for the prediciton are the numeric and categorical features without missing values, seen above.

%%time

numeric_impute_dict = impute_value_generator(df=market_df_copy,

targets=float_features_with_missing,

numeric_predictors=numeric_features_without_missing,

categorical_predictors=categorical_features_without_missing,

target_type="numeric",

sample_size=50000)

Executing iteration for vl_total_veiculos_pesados_grupo

Metrics:

mean absolute error: 1.46

root mean squared error: 21.29

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Executing iteration for vl_total_veiculos_leves_grupo

Metrics:

mean absolute error: 8.98

root mean squared error: 343.97

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Executing iteration for nu_meses_rescencia

Metrics:

mean absolute error: 4.33

root mean squared error: 7.66

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Executing iteration for empsetorcensitariofaixarendapopulacao

Metrics:

mean absolute error: 688.09

root mean squared error: 1165.07

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Executing iteration for qt_socios

Metrics:

mean absolute error: 0.18

root mean squared error: 0.76

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Executing iteration for qt_socios_pf

Metrics:

mean absolute error: 0.19

root mean squared error: 0.96

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Executing iteration for qt_socios_pj

Metrics:

mean absolute error: 0.03

root mean squared error: 0.21

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Executing iteration for idade_media_socios

Metrics:

mean absolute error: 9.08

root mean squared error: 11.48

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Executing iteration for idade_maxima_socios

Metrics:

mean absolute error: 9.55

root mean squared error: 12.1

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Executing iteration for idade_minima_socios

Metrics:

mean absolute error: 9.11

root mean squared error: 11.59

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Executing iteration for qt_socios_st_regular

Metrics:

mean absolute error: 0.2

root mean squared error: 1.13

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Executing iteration for vl_faturamento_estimado_aux

Metrics:

mean absolute error: 729858.65

root mean squared error: 7255688.02

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Executing iteration for vl_faturamento_estimado_grupo_aux

Metrics:

mean absolute error: 21135340.33

root mean squared error: 351252066.68

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Wall time: 7min 54s

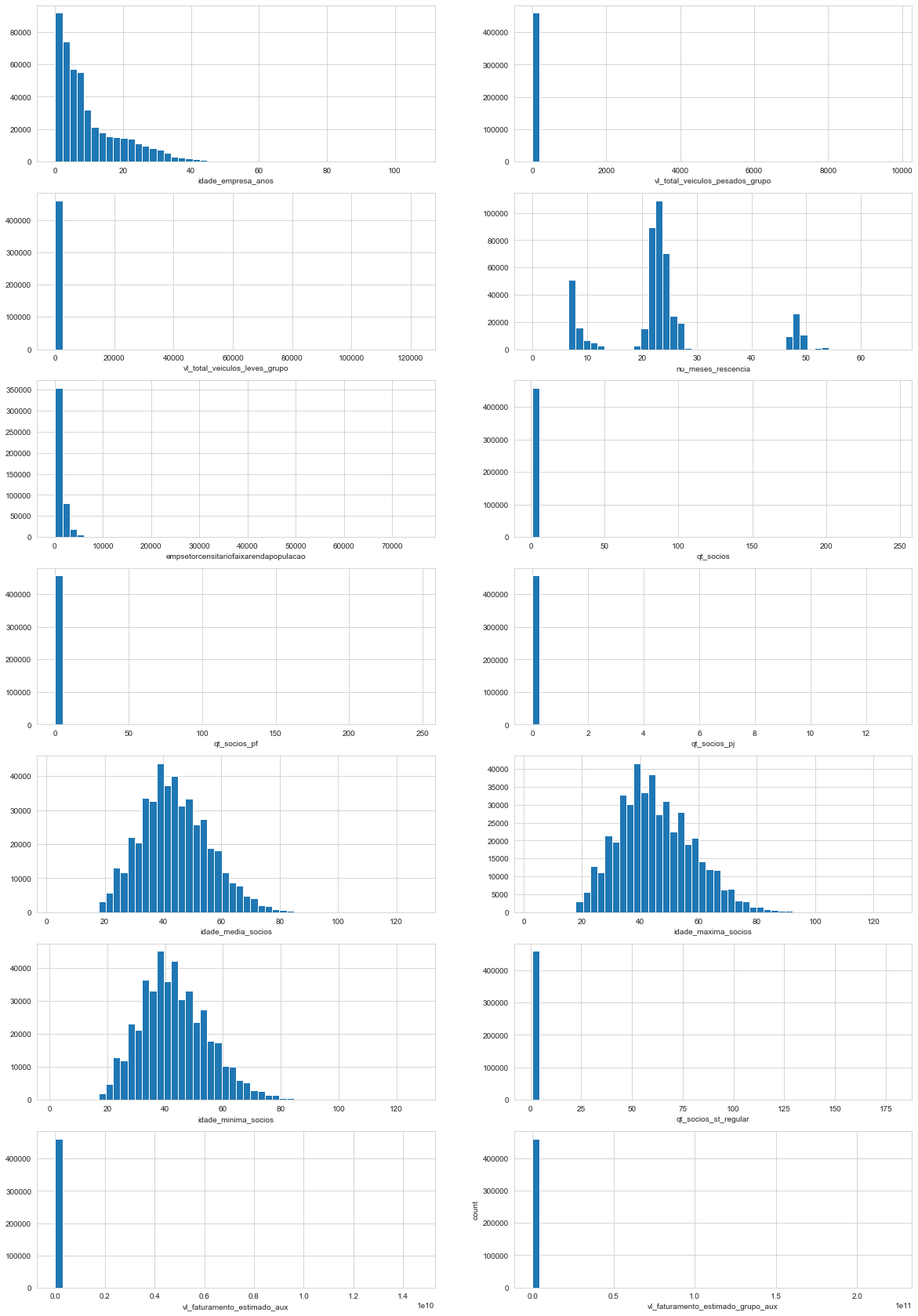

Next, we plot the numeric values to be imputed.

numeric_impute_df = pd.DataFrame({feature: pd.Series(numeric_impute_dict[feature]["impute_variables"]) for feature in [feature for feature in numeric_impute_dict.keys()]})

create_distplots(numeric_impute_df, numeric_impute_df.columns)

The next code block impute the missing values generated (they were created in sequence, so they’ll match the missing values’ positions), and creates yet another plot of all the float features without missing values - e.g. already imputed.

for feature in float_features_with_missing:

market_df_copy.loc[market_df_copy[feature].isna(), feature] = numeric_impute_dict[feature]["impute_variables"]

create_distplots(market_df_copy, float_features)

The float features distributions with imputed missing values are now behaving simmilarly to the original distributions. The table below shows that there are no missing values among the float64 features.

market_control_df = create_control_df(market_df_copy)

market_control_df.loc[float_features, :]

| missing | missing_percentage | type | unique | unique_percentage | |

|---|---|---|---|---|---|

| features | |||||

| idade_empresa_anos | 0 | 0.0 | float64 | 14198 | 3.0712 |

| vl_total_veiculos_pesados_grupo | 0 | 0.0 | float64 | 367 | 0.0794 |

| vl_total_veiculos_leves_grupo | 0 | 0.0 | float64 | 451 | 0.0976 |

| nu_meses_rescencia | 0 | 0.0 | float64 | 1362 | 0.2946 |

| empsetorcensitariofaixarendapopulacao | 0 | 0.0 | float64 | 128572 | 27.8115 |

| qt_socios | 0 | 0.0 | float64 | 489 | 0.1058 |

| qt_socios_pf | 0 | 0.0 | float64 | 567 | 0.1226 |

| qt_socios_pj | 0 | 0.0 | float64 | 102 | 0.0221 |

| idade_media_socios | 0 | 0.0 | float64 | 54658 | 11.8231 |

| idade_maxima_socios | 0 | 0.0 | float64 | 19382 | 4.1925 |

| idade_minima_socios | 0 | 0.0 | float64 | 20598 | 4.4556 |

| qt_socios_st_regular | 0 | 0.0 | float64 | 591 | 0.1278 |

| vl_faturamento_estimado_aux | 0 | 0.0 | float64 | 6527 | 1.4119 |

| vl_faturamento_estimado_grupo_aux | 0 | 0.0 | float64 | 13452 | 2.9098 |

2.6.2 Missing Values of Categorical Features

The following code blocks presents the remaining categorical features (of type object and bool), and their respective count and percentage of missing values.

pd.concat([market_control_df.loc[object_features], market_df[object_features].describe().T[["count", "top", "freq"]]], axis=1).sort_values(by="missing", ascending=False)

| missing | missing_percentage | type | unique | unique_percentage | count | top | freq | |

|---|---|---|---|---|---|---|---|---|

| features | ||||||||

| nm_meso_regiao | 58698 | 12.697 | object | 19 | 0.0041 | 403600 | CENTRO AMAZONENSE | 71469 |

| nm_micro_regiao | 58698 | 12.697 | object | 73 | 0.0158 | 403600 | MANAUS | 60008 |

| de_faixa_faturamento_estimado | 27513 | 5.951 | object | 12 | 0.0026 | 434785 | DE R$ 81.000,01 A R$ 360.000,00 | 273861 |

| de_faixa_faturamento_estimado_grupo | 27513 | 5.951 | object | 11 | 0.0024 | 434785 | DE R$ 81.000,01 A R$ 360.000,00 | 252602 |

| de_saude_tributaria | 14851 | 3.212 | object | 6 | 0.0013 | 447447 | VERDE | 145430 |

| de_saude_rescencia | 14851 | 3.212 | object | 5 | 0.0011 | 447447 | ACIMA DE 1 ANO | 378896 |

| de_nivel_atividade | 11168 | 2.416 | object | 4 | 0.0009 | 451130 | MEDIA | 217949 |

| sg_uf_matriz | 1939 | 0.419 | object | 27 | 0.0058 | 460359 | MA | 124823 |

| setor | 1927 | 0.417 | object | 5 | 0.0011 | 460371 | COMERCIO | 211224 |

| nm_divisao | 1927 | 0.417 | object | 87 | 0.0188 | 460371 | COMERCIO VAREJISTA | 172404 |

| nm_segmento | 1927 | 0.417 | object | 21 | 0.0045 | 460371 | COMERCIO; REPARACAO DE VEICULOS AUTOMOTORES E ... | 211224 |

| de_natureza_juridica | 0 | 0.000 | object | 67 | 0.0145 | 462298 | EMPRESARIO INDIVIDUAL | 295756 |

| sg_uf | 0 | 0.000 | object | 6 | 0.0013 | 462298 | MA | 127654 |

| natureza_juridica_macro | 0 | 0.000 | object | 7 | 0.0015 | 462298 | OUTROS | 320211 |

| de_ramo | 0 | 0.000 | object | 33 | 0.0071 | 462298 | COMERCIO VAREJISTA | 172404 |

| idade_emp_cat | 0 | 0.000 | object | 6 | 0.0013 | 462298 | 1 a 5 | 138580 |

market_control_df.loc[boolean_features].sort_values(by="missing", ascending=False)

| missing | missing_percentage | type | unique | unique_percentage | |

|---|---|---|---|---|---|

| features | |||||

| fl_optante_simples | 82713 | 17.892 | float64 | 2 | 0.0004 |

| fl_optante_simei | 82713 | 17.892 | float64 | 2 | 0.0004 |

| fl_spa | 1927 | 0.417 | float64 | 2 | 0.0004 |

| fl_antt | 1927 | 0.417 | float64 | 2 | 0.0004 |

| fl_veiculo | 1927 | 0.417 | float64 | 2 | 0.0004 |

| fl_simples_irregular | 1927 | 0.417 | float64 | 2 | 0.0004 |

| fl_passivel_iss | 1927 | 0.417 | float64 | 2 | 0.0004 |

| fl_matriz | 0 | 0.000 | float64 | 2 | 0.0004 |

| fl_me | 0 | 0.000 | float64 | 2 | 0.0004 |

| fl_sa | 0 | 0.000 | float64 | 2 | 0.0004 |

| fl_mei | 0 | 0.000 | float64 | 2 | 0.0004 |

| fl_ltda | 0 | 0.000 | float64 | 2 | 0.0004 |

| fl_st_especial | 0 | 0.000 | float64 | 2 | 0.0004 |

| fl_email | 0 | 0.000 | float64 | 2 | 0.0004 |

| fl_telefone | 0 | 0.000 | float64 | 2 | 0.0004 |

| fl_rm | 0 | 0.000 | float64 | 2 | 0.0004 |

Simmilarly to the imputation done to fhe numeric features, we’ll use random forests to classify the missing values. As predictors, this time we’ll use all the numeric features, in which values have been imputed, and the categorical features without missing values.

categorical_features_with_missing = object_features_with_missing + boolean_features_with_missing

print(f"Categorical features with missing values:\n{categorical_features_with_missing}")

Categorical features with missing values:

['setor', 'nm_divisao', 'nm_segmento', 'sg_uf_matriz', 'de_saude_tributaria', 'de_saude_rescencia', 'de_nivel_atividade', 'nm_meso_regiao', 'nm_micro_regiao', 'de_faixa_faturamento_estimado', 'de_faixa_faturamento_estimado_grupo', 'fl_spa', 'fl_antt', 'fl_veiculo', 'fl_optante_simples', 'fl_optante_simei', 'fl_simples_irregular', 'fl_passivel_iss']

%%time

categorical_impute_dict = impute_value_generator(df=market_df_copy,

targets=categorical_features_with_missing,

numeric_predictors=numeric_features,

categorical_predictors=categorical_features_without_missing,

target_type='categorical',

sample_size=50000)

Executing iteration for setor

Metrics:

accuracy: 0.99

Weighted F1 score: 0.99

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Executing iteration for nm_divisao

Metrics:

accuracy: 0.87

Weighted F1 score: 0.89

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Executing iteration for nm_segmento

Metrics:

accuracy: 1.0

Weighted F1 score: 1.0

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Executing iteration for sg_uf_matriz

Metrics:

accuracy: 0.99

Weighted F1 score: 0.99

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Executing iteration for de_saude_tributaria

Metrics:

accuracy: 0.64

Weighted F1 score: 0.64

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Executing iteration for de_saude_rescencia

Metrics:

accuracy: 1.0

Weighted F1 score: 1.0

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Executing iteration for de_nivel_atividade

Metrics:

accuracy: 0.73

Weighted F1 score: 0.74

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Executing iteration for nm_meso_regiao

Metrics:

accuracy: 0.69

Weighted F1 score: 0.71

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Executing iteration for nm_micro_regiao

Metrics:

accuracy: 0.56

Weighted F1 score: 0.6

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Executing iteration for de_faixa_faturamento_estimado

Metrics:

accuracy: 0.99

Weighted F1 score: 0.99

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Executing iteration for de_faixa_faturamento_estimado_grupo

Metrics:

accuracy: 0.99

Weighted F1 score: 0.99

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Executing iteration for fl_spa

Metrics:

accuracy: 1.0

Weighted F1 score: 1.0

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Executing iteration for fl_antt

Metrics:

accuracy: 0.99

Weighted F1 score: 1.0

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Executing iteration for fl_veiculo

Metrics:

accuracy: 0.99

Weighted F1 score: 0.99

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Executing iteration for fl_optante_simples

Metrics:

accuracy: 0.81

Weighted F1 score: 0.81

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Executing iteration for fl_optante_simei

Metrics:

accuracy: 1.0

Weighted F1 score: 1.0

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Executing iteration for fl_simples_irregular

Metrics:

accuracy: 1.0

Weighted F1 score: 1.0

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Executing iteration for fl_passivel_iss

Metrics:

accuracy: 0.88

Weighted F1 score: 0.88

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Wall time: 2min 42s

Next, the categorical features with missing values are imputed and countplots are generated.

for feature in categorical_features_with_missing:

# Re-transforming the predicted classes from numbers to labels.

_to_impute = categorical_impute_dict[feature]["label_encoder"].inverse_transform(categorical_impute_dict[feature]["impute_variables"])

market_df_copy.loc[market_df_copy[feature].isna(), feature] = _to_impute

create_barplots(market_df_copy, object_features, n_labels=10)

The result printed next shows that there are no more missing values in our dataset.

print(f"The percentage of missing values in the market dataset is {round(100*(market_df_copy.isna().sum().sum() / market_df_copy.size))} %")

The percentage of missing values in the market dataset is 0 %

2.7 Feature Selection

In the next step we try to reduce our feature space by using a feature selection technique that can deal with sparse matrices.

def truncated_SVD_selector(df, numeric_features, categorical_features, n_components=250, evr=None):

"""

Feature selection by the use of truncatedSVD.

:param df: Pandas DataFrame with the data for the feature selection to be applied.

:param numeric_features: list, must contain names of the numeric features in the dataset.

:param categorical_features: list, must contain names of the categorical features in the dataset.

:param n_components: integer, number of principal components.

:return: array containing the number of features defined with n_components and the pipeline used to process the features.

"""

# Sciki-learn pipeline and column transformer

cat_pipeline = Pipeline(steps=[

("onehot", OneHotEncoder(drop="first", dtype=np.int32))

])

num_pipeline = Pipeline(steps=[

("scaler", Normalizer())

])

transformer = ColumnTransformer(transformers=[

("categorical", cat_pipeline, categorical_features),

("numeric", num_pipeline, numeric_features)

])

pipeline = Pipeline(steps=[

("transformer", transformer),

("feature_selection", TruncatedSVD(n_components=n_components, algorithm="arpack", random_state=0))

])

processed_df = pipeline.fit_transform(df)

if not evr:

return processed_df, pipeline

else:

explained_variance_ratio = np.cumsum(pipeline.get_params()["feature_selection"].explained_variance_ratio_)

n_PCs = explained_variance_ratio[(explained_variance_ratio <= evr)].argmax()

return processed_df[:, 0:n_PCs], pipeline

def evr_plot(pipeline):

"""

Plot cumulative explained variance ratio for the feature selection algorithm used in the pipeline. To be used in conjunction with the output pipeline of\n

the function "truncated_SVD_selector".

:param pipeline: output of the function "truncated_SVD_selector", scikit-learn pipeline with a step called "feature_selection", which contains the\n

feature selection algorithm.

"""

explained_variance_ratio = pipeline.get_params()["feature_selection"].explained_variance_ratio_

g = sns.lineplot(np.arange(len(explained_variance_ratio)), np.cumsum(explained_variance_ratio))

g.axes.axhline(0.995, ls="--", color="red")

plt.xlabel('Number of components')

plt.ylabel('Cumulative explained variance');

%%time

array_df_final, feature_selection_pipeline = truncated_SVD_selector(df=market_df_copy,

numeric_features=numeric_features,

categorical_features=categorical_features,

n_components=250,

evr=0.995)

Wall time: 26.5 s

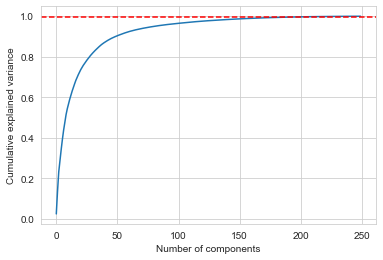

It’s possible to see through the plot below the approximate number of components to obtain 99.5% explained variance ratio - observe that the function encodes categorical features with one hot encoder thus the feature space is way bigger (contains around 430 features, as denoted below) than the previously treated dataframe, which contained 47 features.

The feature selection function is called with the paramater evr set to 0.995 so that the resulting matrix has the number of components required to match this percentage of explained variance.

market_control_df = create_control_df(market_df_copy)

unique_classes = market_control_df.loc[categorical_features, "unique"].sum()

estimated_max_components = unique_classes + len(numeric_features)

print(f"Dimension of the dataframe without missing values: {market_df_copy.shape}")

print(f"The estimated max number of components is {estimated_max_components}")

print(f"Dimension of the processed market dataset: {array_df_final.shape}")

Dimension of the dataframe without missing values: (462298, 47)

The estimated max number of components is 436

Dimension of the processed market dataset: (462298, 190)

evr_plot(feature_selection_pipeline)

3 Algorithm Evaluation and Overview of Steps to be Taken

3.1 Types of Recommender Systems

A type of algorithm known as Recommender System is the first thing that comes to mind considering the problem at hand: to provide an automated service that recommends new business leads to a user given his current clients portfolio. There’s many different approaches to create a Recommender System, which depend on the original data format and size.

The main approaches are:

-

Simple Recommenders / Popularity Based System: In popularity based recommender systems, the “knowledge of the masses” is used to make recommendations based on, you guessed, what most people like. There is a nice example in the link.

-

Collaborative Filtering: In collaborative filtering, the interests of many users (hence collaborative) are used to filter the data and predict the tastes of a certain user. The main idea is that a user gets better recommendations from people that have similar preferences. Usually, it is required that the data presents a user database, and item database, and a way to infer user preferences regarding the items, which may be explicit, like ratings given by each user to the respective item, or it may be some sort of implicit rating as well, like clicks on a type of add. Commonly, the system may be constructed by looking for users that rate items simmilarly, or look for simmilarities between items.

-

Content Based Fitering: In content based filtering, the idea is to compare items based on their features/contents, and then recommend similar items to the ones a user has interacted in the past (like with the profiles at hand). There are several learning techniques to learn a user profile.

-

Hybrid Methods: As the name says, this approach combines different techinques, as in content based filtering, collaborative filtering, etc., to create recommendations based not only on user ratings, but also in items features and characteristics.

3.2 Selected Approach and Steps

That said, after experimentation, research and input from felow students and the community, For this project, a Content Based Filtering Recommender System based in Logistic Regression is going to be used. It’s not quite a recommender system per se (at least not like the ones I found), e.g. it does not uses technologies as TF-IDF, Matrix Factorization, similarity comparison through euclidean/cosine distances, but it does recommend leads!

The steps taken, overall, are:

- The companies that are already clients can be used as targets provided they’re encoded as 0s and 1s, or False and True.

- The processed database can be used as predictors.

- We aim not to obtain the classifications per se, but the logistic regression predicted probability that the company is indeed a client. With this, we can sort the recommended companies based on the predicted probability that they’re clients.

- Since there’s almost 470E3 companies, we’ll use KMeans clustering to group the companies and train logistic regressions for each group.

- The data is very imbalanced - each portfolio has around 500 companies, and we’ve just cited the size of the dataframe with all companies. We’ll use SMOTE oversampling along the training sets to address this issue.

- Metrics will be calculated for the trained logistic regression and recommendations made using portfolio 2.

- The recommendations made will be evaluated through the MAP@k metric.

It can be argued that it’s a matter of adapting the dataset so that we obtain the required format required by each approach. That said, to the problem and dataset at hand:

-

Three portfolios are presented - our user base is of three, and usually to use collaborative filtering many users would be needed (creating simulated profiles could be an idea here).

-

These portfolios do not present user ratings (not explicitly, at least) on each of the “items”, which are the clients.

-

As seen in the previous exploratory data analysis section, each client presents several features that may be used to identify similar observations/clients.

4 Model Training

4.1 Load Portfolio Data

portfolio1 = pd.read_csv('../data/estaticos_portfolio1.csv', usecols=["id"])

portfolio2 = pd.read_csv('../data/estaticos_portfolio2.csv', usecols=["id"])

portfolio3 = pd.read_csv('../data/estaticos_portfolio3.csv', usecols=["id"])

Checking if the clients ID’s from the portfolios are in the main database.

def check_portfolio_info(database, portfolio):

"""

Check if the database contains the portfolios' IDs.

The portfolio and database must contain `id` as a feature.

:param database: Pandas DataFrame, contains all the companies' IDs as feature `id`.

:param portfolio: Pandas DataFrame, contains only the portfolio clients' IDs as feature `id`.

"""

print(f"Database size: {database.shape[0]}")

print(f"Portfolio size: {portfolio.shape[0]}")

# Test - check if database contains portfolios' IDs

assert np.all(portfolio["id"].isin(database["id"])), "Test 1: NOT OK - Not all the portfolios' ids are in the database"

print("Test: OK - All the portfolios' ids are in the database\n")

print(169*"-")

for portfolio, number in zip([portfolio1, portfolio2, portfolio3], range(1,4)):

print(f"\nTesting Portfolio {number}\n")

check_portfolio_info(IDs, portfolio)

Testing Portfolio 1

Database size: 462298

Portfolio size: 555

Test: OK - All the portfolios' ids are in the database

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Testing Portfolio 2

Database size: 462298

Portfolio size: 566

Test: OK - All the portfolios' ids are in the database

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Testing Portfolio 3

Database size: 462298

Portfolio size: 265

Test: OK - All the portfolios' ids are in the database

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------

4.2 “Companies Profile” Table / Principal Components DataFrame

Below, we’re getting all companies IDs and principal components in a dataframe.

columns_names = []

for PC in range(1, array_df_final.shape[1]+1):

columns_names.append("PC_" + str(PC))

companies_profile = pd.DataFrame(array_df_final, columns=columns_names, index=IDs["id"])

print(f"Dimension of companies profile table: {companies_profile.shape}")

Dimension of companies profile table: (462298, 190)

companies_profile.head()

| PC_1 | PC_2 | PC_3 | PC_4 | PC_5 | PC_6 | PC_7 | PC_8 | PC_9 | PC_10 | ... | PC_181 | PC_182 | PC_183 | PC_184 | PC_185 | PC_186 | PC_187 | PC_188 | PC_189 | PC_190 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| id | |||||||||||||||||||||

| a6984c3ae395090e3bee8ad63c3758b110de096d5d819583a784a113726db849 | 2.292665 | 0.967004 | 0.524173 | 1.784401 | 1.242783 | -1.239186 | -0.735621 | -0.439312 | 0.672232 | -0.426301 | ... | -0.001614 | 0.006139 | 0.002382 | -0.000965 | -0.000749 | 0.004624 | 0.000812 | -0.001456 | -0.001636 | -0.000758 |

| 6178f41ade1365e44bc2c46654c2c8c0eaae27dcb476c47fdef50b33f4f56f05 | 3.336731 | 1.045422 | 0.566630 | -0.524458 | -1.266166 | -0.367399 | 0.289703 | 0.850979 | 1.898394 | 0.024087 | ... | 0.001079 | -0.000793 | 0.002951 | 0.001739 | -0.001068 | 0.001770 | -0.000971 | 0.001262 | -0.000861 | 0.001222 |

| 4a7e5069a397f12fdd7fd57111d6dc5d3ba558958efc02edc5147bc2a2535b08 | 3.108096 | 0.390482 | 1.935537 | 0.698707 | -0.489345 | 1.753825 | 0.001656 | 0.009493 | -0.459895 | -0.445723 | ... | 0.004685 | -0.007768 | -0.000862 | -0.004139 | 0.000505 | -0.005168 | 0.003042 | 0.003073 | 0.002088 | 0.001613 |

| 3348900fe63216a439d2e5238c79ddd46ede454df7b9d8c24ac33eb21d4b21ef | 3.385046 | 1.455910 | 0.207190 | 0.563407 | -1.110875 | 1.221657 | -0.056992 | 0.037638 | -0.613693 | 0.259963 | ... | 0.000043 | 0.001319 | -0.003288 | 0.000750 | 0.000983 | -0.005605 | -0.006377 | 0.002499 | -0.000603 | 0.000628 |

| 1f9bcabc9d3173c1fe769899e4fac14b053037b953a1e4b102c769f7611ab29f | 3.179317 | 1.101441 | 0.609660 | 0.723841 | -0.437394 | -1.381790 | -0.780493 | 0.073937 | -0.232520 | -0.133044 | ... | -0.002587 | 0.003825 | 0.004799 | -0.001196 | -0.001686 | -0.005309 | 0.000535 | -0.000913 | 0.002159 | 0.003171 |

5 rows × 190 columns

We’ll save the companies profile table with the principal components in a .zip file to use it later in the webapp. We’re using float as “float16”, which implies loosing some information, but it is needed so that the webapp can be deployed later.

# %%time

# split_size = 8

# for idx, df_i in enumerate(np.array_split(companies_profile, split_size)):

# df_i.to_csv(path_or_buf=f"../output/companies_profile_{idx}.bz2", float_format=np.float16, compression="bz2")

Wall time: 1min 20s

4.3 Clustering Companies with MiniBatchKMeans

Next, we’re clustering the companies based on their features to reduce the number of companies we use to train the model upon each iteration and improve classifications. We set a minimum limit to the reduction in heterogeneity for increases in the number of clusters.

The KMeans algorithm divides the companies (see companies_profile above) in three clusters.

def find_cluster(df, n_features=1, sse_limit=0.05, flag_start=2):

"""

Use MiniBatchKMeans to find clusters in the dataset. It compares two groupings at each iterations, if\

reduction in heterogeneity is inferior to threshold, return fitted algorithm.

:param df: Pandas DataFrame to find clusters on.

:param n_features: integer, number of features to be used from the dataframe.

:param sse_limit: float, limit to the reduction in heterogeneity

:param flag_start: integer, minimum number of clusters to start the comparisons.

:return: fitted MiniBatchKMeans object and pandas series with cluster labels.

"""

#build two kmeans models starting with 2 and 3 clusters and repeat until dss < sse_limit

flag = flag_start

kmeans1 = MiniBatchKMeans(n_clusters=flag, random_state=0)

if n_features == 1:

kmeans1.fit(df.iloc[:, 0].values.reshape(-1, 1))

else:

kmeans1.fit(df.iloc[:, 0:n_features].values)

while True:

flag += 1

kmeans2 = MiniBatchKMeans(n_clusters=flag, random_state=0)

if n_features == 1:

kmeans2.fit(df.iloc[:, 0].values.reshape(-1, 1))

else:

kmeans2.fit(df.iloc[:, 0:n_features].values)

#decision criterion - additional cluster should reduce heterogeneity to not less than sse_limit

dss = (kmeans1.inertia_ - kmeans2.inertia_)/kmeans1.inertia_

print(f"From {flag-1} to {flag} clusters -> Reduction in heterogeneity: {dss}")

if dss < sse_limit:

break

kmeans1 = kmeans2

return kmeans1, pd.Series(kmeans1.labels_, name="cluster")

%%time

kmeans, cluster_labels = find_cluster(companies_profile, n_features=5, sse_limit=0.2, flag_start=1) # fitted kmeans and cluster labels, turn to pd.Series

From 1 to 2 clusters -> Reduction in heterogeneity: 0.2980609344696506

From 2 to 3 clusters -> Reduction in heterogeneity: 0.259998847972185

From 3 to 4 clusters -> Reduction in heterogeneity: 0.1581394378991338

Wall time: 52.6 s

Parser : 393 ms

We’ll save the cluster labels vector in a .zip file to use it later in the webapp.

# %%time

# compression_opts = dict(method="zip", archive_name="cluster_labels.csv")

# cluster_labels.to_csv(path_or_buf="../output/cluster_labels.zip", compression=compression_opts)

Wall time: 4.28 s

Parser : 442 ms

4.4 Functions to Create Rating table and to Train Logistic Regression by Cluster

Now, some functions are defined and used to train the model by cluster:

create_rating_dfmaps the clients in a portfolio to the companies_profile and to a defined cluster.train_classifiersfor each cluster and based on the portfolios’ clients and the companies_profile - applies train_test_split, SMOTE oversampling, trains logistic regression, makes predictions and saves the trained model along with metrics.

def create_rating_df(portfolio, companies_profile, cluster_labels):

"""

Create rating dataframe - a dataframe with columns:

- id: the id of the company

- client: if the company is a client (present) on the porfolio

- cluster: to which cluster the company belongs

:param portfolio: pandas dataframe with column "id", portfolio with client companies ids.